Homeowners Insurance in and around Roanoke

Looking for homeowners insurance in Roanoke?

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

Home Is Where Your Heart Is

Home is where family gathers laughter never ends, and you're insured by State Farm. It just makes sense.

Looking for homeowners insurance in Roanoke?

Help protect your home with the right insurance for you.

State Farm Can Cover Your Home, Too

You’ll get that and more with State Farm homeowner’s insurance. State Farm has coverage options to keep your home and everything in it safe. You’ll get a policy that’s modified to correspond with your specific needs. Thank goodness that you won’t have to figure that out on your own. With personal attention and outstanding customer service, Agent Betsy Thomas can walk you through every step to generate a plan that protects your home and everything you’ve invested in.

Don't let your homeowners insurance go over your head, especially when the unforeseeable occurs. State Farm can bear the load of helping you get the home coverage you need. And if that's not enough, bundle and save could be the crown molding to your coverage options. Contact Betsy Thomas today for more information!

Have More Questions About Homeowners Insurance?

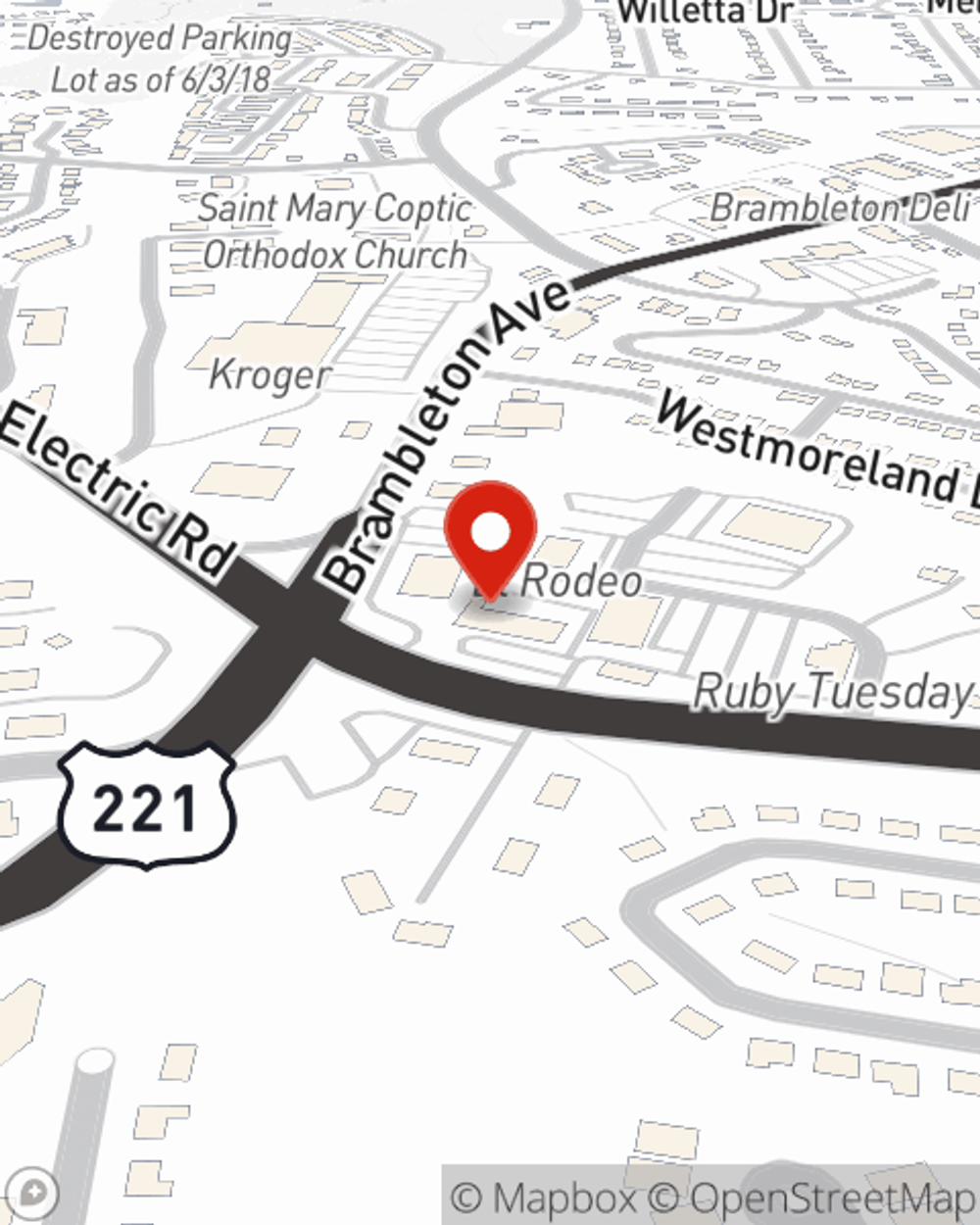

Call Betsy at (540) 774-1669 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Things to consider when replacing a roof

Things to consider when replacing a roof

When your house needs a roof replacement, you might wonder what material and warranty options there are. Learn about some questions to ask a roofing contractor.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.

Betsy Thomas

State Farm® Insurance AgentSimple Insights®

Things to consider when replacing a roof

Things to consider when replacing a roof

When your house needs a roof replacement, you might wonder what material and warranty options there are. Learn about some questions to ask a roofing contractor.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.